Fees Matter

Take Action Against Excessive 401(k) Fees

What You Need To Know: 1% less in annual fees over an investment lifetime means 10 years longer in retirement. Said another way, you will run out of money if you don’t take action to reduce fees.

The tale of three friends…

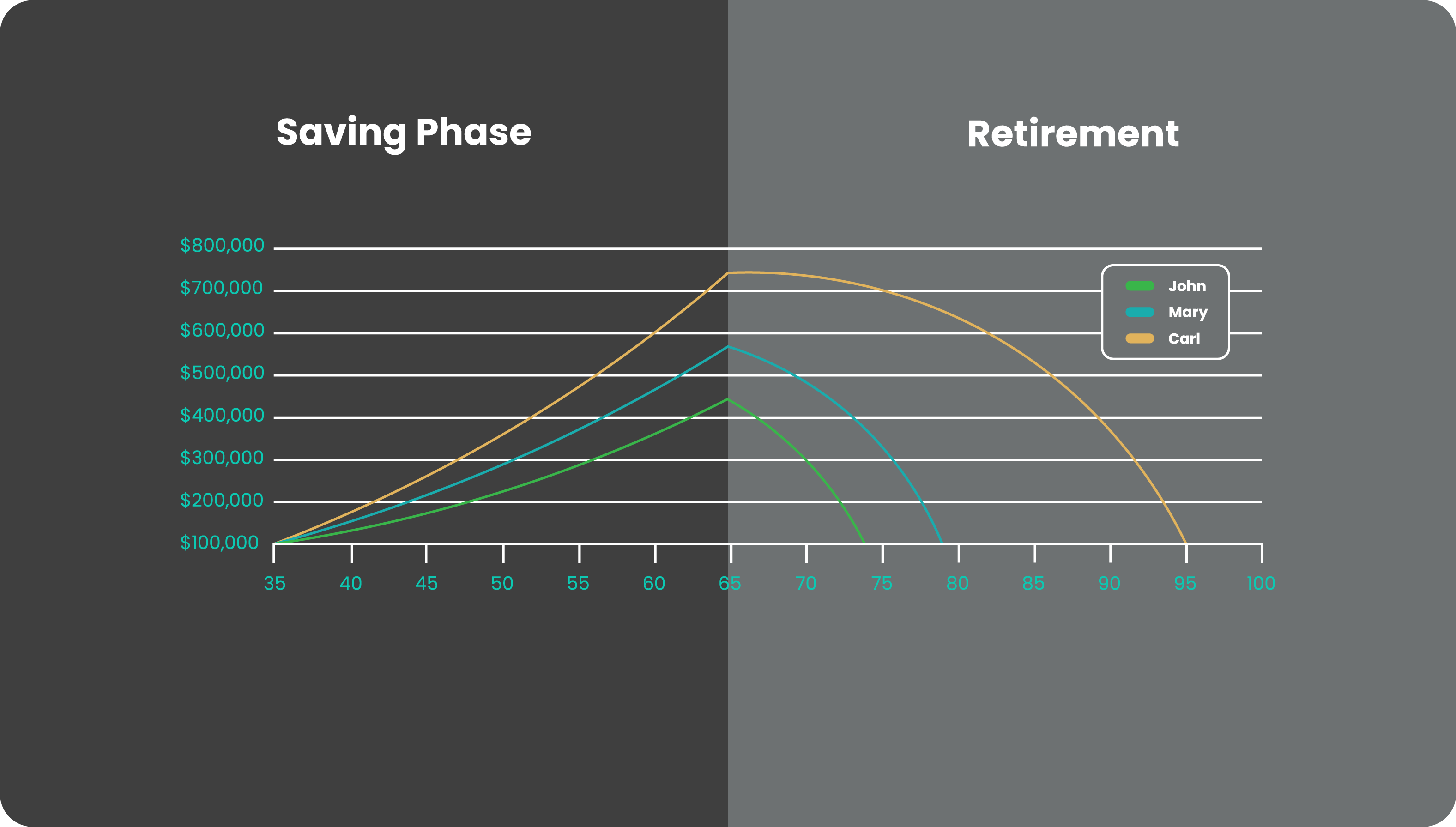

Three childhood friends, John, Mary, and Carl, at age 35, all have $100,000 to invest. Each selects a different mutual fund, and all three are lucky enough to have equal performance in the market of 8% annually. At age 65, they get together to compare account balances. On deeper inspection, they realize that the fees they have been paying are drastically different from one another. They are paying annual fees of 1%, 2%, and 3% respectively.

Below is the impact of fees on their ending account balance:

John

$100,000

growing at 8%

3% fees

=

$432,194

Mary

$100,000

growing at 8%

2% fees

=

$574,349

Carl

$100,000

growing at 8%

1% fees

=

$761,225

Same investment amount, same returns, and Carl has nearly twice as much money as his friend John. Which horse do you bet on? The one with the 100-pound jockey or the 300-pound jockey?

When it came time for retirement, John, Mary and Carl each needed $60,000 for retirement. As you can see from the chart below, John (with the highest fee) ran out money before his 75th birthday while Carl’s money lasts until age 95.

This is a hypothetical example for illustrative purposes only. Your results may vary.

Warning to employers

Plan sponsors have a fiduciary responsibility under ERISA to determine if the fees paid by a plan to its service providers are both reasonable and necessary.

According to public policy think-tank Demos, the average worker will lose $154,794 to 401(k) fees over his lifetime (based on annual income of approximately $30,000 per year and saving 5% of his income each year). A higher-income worker, making approximately $90,000 per year, will lose upward of $277,000 in fees in his/her lifetime (Source: The Retirement Savings Drain: The Hidden and Excessive Costs of 401(k)’s)

© 2022 The 401(k)ompany, All rights reserved.

Securities and Investment Advisory Services offered through A.G.P. / Alliance Global Partners, Member of FINRA | SIPC, a Registered Investment Adviser. Neither A.G.P nor any of its affiliates provide legal, tax or accounting advice.

Investing always involves risk; no investment is protected against loss. Past performance does not indicate future results. Diversification does not ensure a profit or protect against declining markets. Consider your investment objectives before investing.

The A.I.D. Group is not a registered broker-dealer or investment advisory firm. The A.I.D. Group and AGP are independent and not affiliated entities.

Check the background of our investment professionals on FINRA's BrokerCheck

Business Continuity Planning Summary & Disclosure

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The CLU® and ChFC(R) marks are the property of The American College, which reserves sole rights to its use, and is used by permission.